what percent is taken out of paycheck for taxes in massachusetts

The amount of federal and Massachusetts income tax withheld for the prior year. The 15th day of the 4th month for fiscal year filings.

Guide For Viewing And Updating Payroll And Compensation Information Mass Gov

For unemployment insurance information call 617 626-5075.

. The average amount taken out is 15 or more for deductions including social security. The tax rate is 6 of the first 7000 of taxable income an employee earns annually. No Massachusetts cities charge their own local income tax.

The income tax rate in Massachusetts is 500. The percentage of taxes taken out of a paycheck depends on the number of exemptions you are allowed to claim. Switch to Massachusetts hourly calculator.

Based on your pay rate and the W-4 you filled out they will deduct about 28 for the Federal Government plus SSIC. Your employer will deduct 53 of your wages for Massachusetts income tax. Overview of Massachusetts Taxes.

Calculate your Massachusetts net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Massachusetts paycheck calculator. Calculate the sum of all assessed taxes including Social Security Medicare and federal and state withholding information found on a W-4. A 2020 or later W4 is required for all new employees.

That rate applies equally to all taxable income. For 2022 tax brackets visit this page from the IRS. On or before April 15 for calendar year filings.

The amount of money you earn during your pay period when viewed with your filing status determines your income bracket and associated federal income tax rate. The information provided by the Paycheck Calculator provides general information regarding the calculation of taxes on wages for Massachusetts residents only. State residents who would like to contribute more to the states coffers also have the option to pay a higher income tax rate.

1240 up to an annual maximum of 147000 for 2022 142800 for 2021. Amount taken out of an average biweekly paycheck. This is because the 53 flat tax rate is applied against your taxable income which is equal to your.

The Paycheck Calculator may not account for every tax or fee that applies to you or your employer at any. Note that you can claim a tax credit of up to 54 for paying your Massachusetts state unemployment taxes in full and on time each quarter which means that youll effectively be paying only 06 on your FUTA tax. That goes for both earned income wages salary commissions and unearned income interest and dividends.

The total Social Security and Medicare taxes withheld. Amount taken out of an average biweekly paycheck. Check out our new page Tax Change to find out how federal or state tax changes affect your take home pay.

MA taxes ordinary income at a flat rate of 53 however your withholding may be at a rate that is lower then this amount depending on the number of exemptions you claim on Form M-4. It is not a substitute for the advice of an accountant or other tax professional. Tax year 2022 Withholding.

The Paycheck Calculator may not account for every tax or fee that applies to you or your employer at any. Although Massachusetts still levies a 625 percent sales tax on most tangible items there are quite a few exemptions including food healthcare items and more. W4 Employee Withholding Certificate The IRS has changed the withholding rules effective January 2020.

Contacting the Department of Unemployment Assistance to fulfill obligations for state employment security taxes. Unlike with the federal income tax there are no tax brackets in Massachusetts. Is mass tax exempt.

Amount taken out of an average biweekly paycheck. Take-home pay is the net amount of income received after the deduction of taxes benefits and voluntary contributions from a paycheck. Tax year 2021 File in 2022 Nonresident.

Divide this number by the gross pay to determine the percentage of taxes taken out of a. The Social Security tax rate is 620 total including employer contribution. It is not a substitute for the advice of an accountant or other tax professional.

Total income taxes paid. Massachusetts Salary Paycheck Calculator. The information provided by the Paycheck Calculator provides general information regarding the calculation of taxes on wages for Massachusetts residents only.

You Should Never Say I Cant Afford That. Where Do Americans Get Their Financial Advice. Everything You Need To Know About Taxes This Year Rich Dad Poor Dad Author Robert Kiyosaki.

For more information about or to do calculations involving Social Security please visit the Social Security Calculator. What percentage is taken out of paycheck. Massachusetts is a flat tax state that charges a tax rate of 500.

Massachusetts State 2022 Taxes Forbes Advisor

Massachusetts Paycheck Calculator Smartasset

What Are Payroll Taxes And Who Pays Them Tax Foundation

2022 Federal State Payroll Tax Rates For Employers

New Tax Law Take Home Pay Calculator For 75 000 Salary

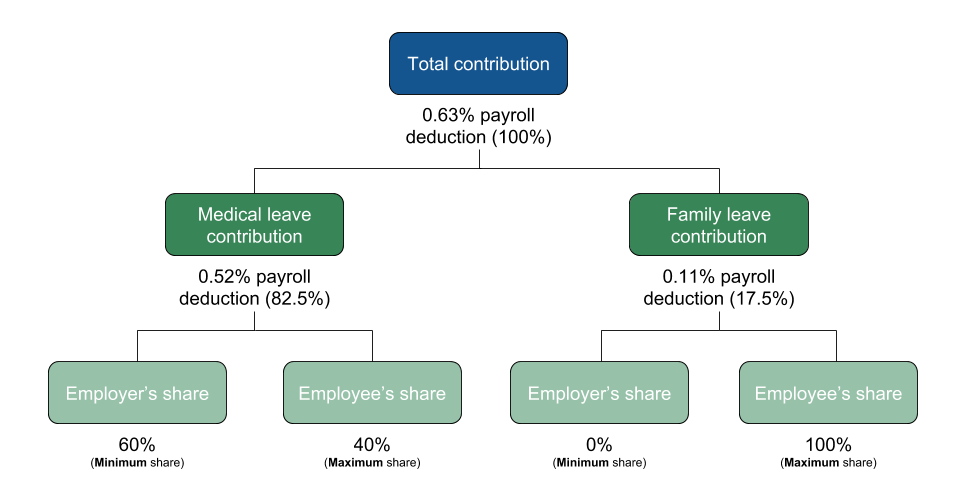

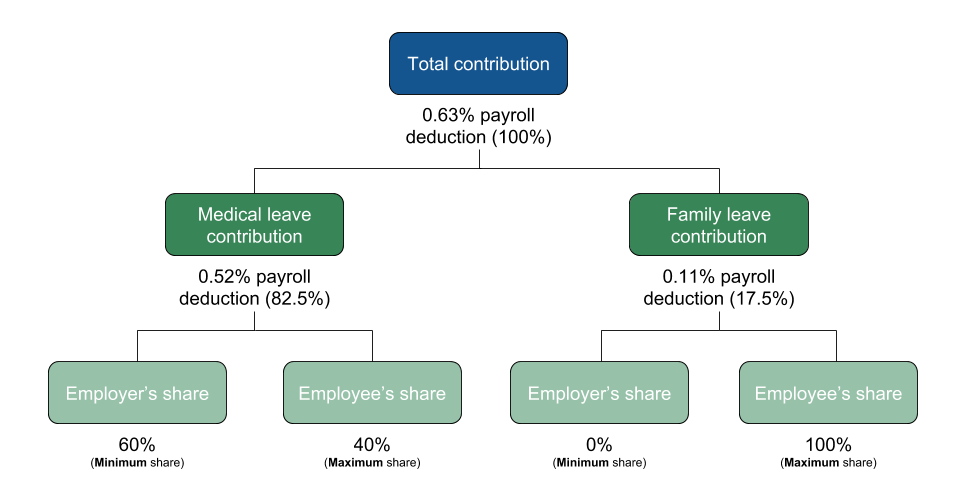

Massachusetts Announces Contribution Rates Effective July 1 For Paid Family Leave

Tax Withholding For Pensions And Social Security Sensible Money

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

Massachusetts Income Tax Calculator Smartasset

Massachusetts Property Tax Calculator Smartasset

Massachusetts Paycheck Calculator Adp

Massachusetts Paycheck Calculator Smartasset

Payroll For North America Updates State Paid Family And Medical Leave Quest Oracle Community

Massachusetts Income Tax Calculator Smartasset

Here S How Much Money You Take Home From A 75 000 Salary

Learn More About The Massachusetts State Tax Rate H R Block